Sahara Farms Agtech De-Risking Africa's Sustainable

Agri-Investment

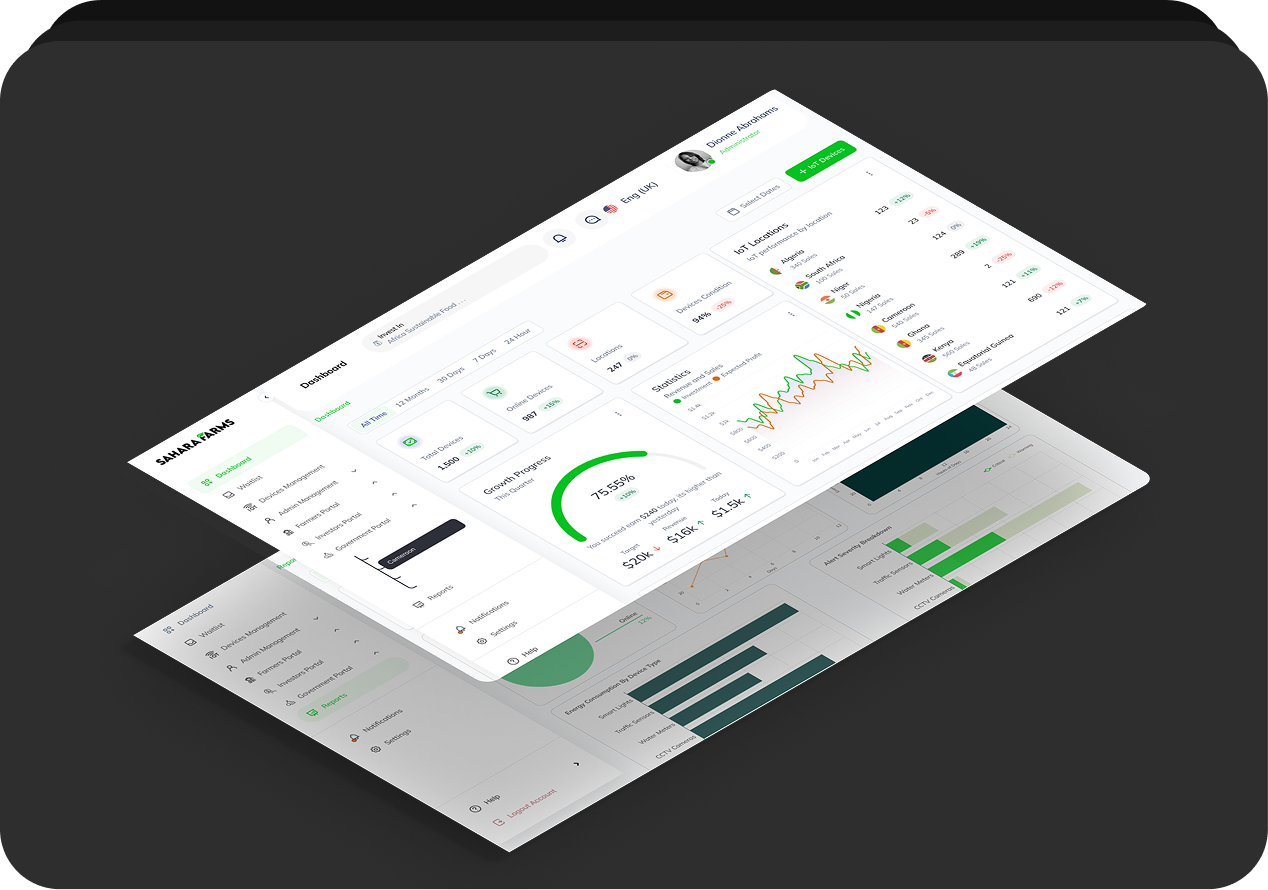

AI-native, algorithmic Blockchain-powered agricultural intelligence for climate-smarter agri-investment in Africa.

We power your agricultural investment and portfolio management decisions by fusing soil-sensing, IoT, and verified ground-truth data into institutional-grade agronomic insights.

An integrated platform - One ecosystem.

Unmatched Data Supremacy

An Integrated

Platform-One Ecosystem

Farmers

Investors

Governments

Platform features

Transforming African Sustainable Agriculture at Scale

Satellite/Drone Imaging

Daily updates on our IoT sensor networks (soil, weather, crop health, harvest forecasts).

Market Pulse Engine

Real-time Pricing from 12 African Commodity Exchanges.

Sovereign-grade Tools

Government Dashboards, Farmers App, Investor Portal.

Blockchain-verified Supply Chain

Multi-layered transactions authentication across the platform value chain.

Accuracy

We are always up to serve you with our AI-Powered Yield Predictions.

Live Data Computing

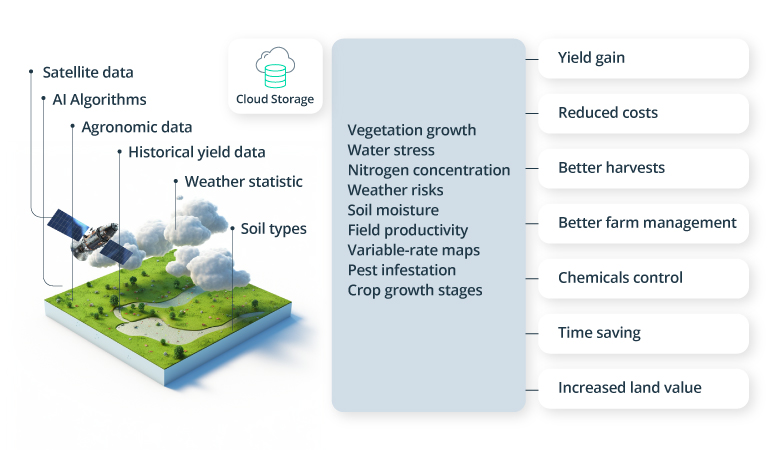

Patented data fusion - algorithms processing (50+ parameters per hectare)

Proprietary OS - Data Fusion Technology

Our proprietary Agtech ecosystem delivers ground-truth agricultural intelligence.

An Integrated Platform - One Ecosystem

Transforming African agricultural farms into sustainable data-driven investable assets

175M+

Ha of Small Farms

1.4B+

Consumers' Market

43+

Countries

$400B+

Market Size

We Don't Just Report Africa's Agricultural Economy - We Intrument It's Transformation

Become a partner in revolutionizing African Agriculture through data-driven intelligence.

Frequently Asked Questions

What is the core problem the Sahara Farms platform solves?

Our platform directly addresses the fundamental capital mismatch in agriculture. Traditional financing often fails to align with the seasonal, long-cycle nature of farming, leading to chronic undercapitalization. We solve this by connecting specialized capital to specific, high-need segments of the crop lifecycle, ensuring farmers get the right type of funding at the right time.

How does the platform "match capital to the crop lifecycle"?

We break the agricultural value chain into distinct phases (e.g., pre-planting, cultivation, harvest, post-harvest). Investors can then choose to fund the specific phase that matches their risk-return profile and expertise. For example, one investor might fund input procurement, while another might fund storage and marketing. This creates a more efficient and tailored financial ecosystem than a single, blanket loan.

What does "secured by seasonal farm equity and forward demand" mean?

This is our dual-layer risk mitigation model. First, the capital provided is secured against the value of the growing crop itself ("seasonal farm equity"). Second, we further de-risk the investment by pre-matching the harvest to committed buyers with forward contracts ("forward market demand"). This ensures there is a known market and price for the crop before it's even planted, protecting both the farmer and the investor.

Who benefits from this platform and how?

• Farmers & Cooperatives: Gain access to timely, structured capital that is aligned with their crop cycle, reducing financial stress and allowing them to focus on production. • Investors & Funders: Access a new, tangible asset class (agriculture) with clear risk mitigation through crop collateral and guaranteed offtake. They can invest in specific, understood segments of the chain. • The Overall Sector: Benefits from reduced fragmentation, increased transparency, and a more resilient, financially secure agricultural value chain from seed to market.